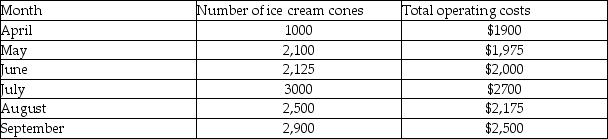

Jones Ice Cream Stand is operated by Mr. Jones and experiences different sales patterns throughout the year. To plan for the future, Mr. Jones wants to determine its cost behavior patterns. He has the following information available about the ice cream stand's operating costs and the number of soft serve cones served.  Using the high-low method, the monthly operating costs if Mr. Jones sells 1440 ice cream cones in a month are (Round any intermediary calculations to the nearest cent.)

Using the high-low method, the monthly operating costs if Mr. Jones sells 1440 ice cream cones in a month are (Round any intermediary calculations to the nearest cent.)

Definitions:

Operating Income

Income generated from a company's primary business activities, excluding deductions for interest and taxes.

Cash Sales

Revenue generated from transactions where payment is made in cash immediately upon purchase.

Supplies Expense

Supplies Expense represents the cost consumed in the use of supplies, such as office supplies, during a reporting period.

Rent Expense

the cost incurred by a company to utilize property or equipment for business operations, typically recognized over the lease term.

Q12: A deodorant manufacturer offers the following information:

Q16: The effect of a plant closing on

Q30: Relevant information is future data that do

Q32: Equivalent units are calculated by<br>A)multiplying the physical

Q108: Perry Corporation produces and sells a single

Q149: Assume no beginning WIP Inventory. The ending

Q190: Yummy Tummy Desserts has2600 quarts of ice

Q197: During a period, 39,200 units were completed

Q236: When ABC, Inc. changes the selling price

Q254: Garfield Corporation is considering building a new