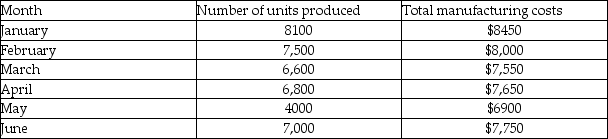

To follow is information about the units produced and total manufacturing costs for Pine Enterprises for the past six months.  Using the high-low method, what is the variable cost per unit?

Using the high-low method, what is the variable cost per unit?

Definitions:

Indirect Expense

Costs incurred that are not directly tied to the production of goods or services, such as rent, utilities, and administrative salaries.

Depreciation Expense

Depreciation expense is the allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value due to wear and tear, decay, or obsolescence.

Department Store

A retail establishment offering a wide range of consumer goods in different product categories known as "departments."

Profit Center

A department or unit within a company responsible for generating profits, with its performance measured based on its ability to produce excess revenue over expenses.

Q13: Jackie's Snacks sells fudge, caramels, and popcorn.

Q13: Within the relevant range, which of the

Q35: Gross margin is another term for net

Q72: Costs incurred in detecting poor quality goods

Q81: Richland Enterprises has budgeted the following amounts

Q136: Schrute Farm Sales buys portable generators for

Q180: To find the number of units that

Q199: When units are sold, Cost of Goods

Q248: It costs Homer's Manufacturing $0.65 to produce

Q298: The X Variable 1 Coefficient in regression