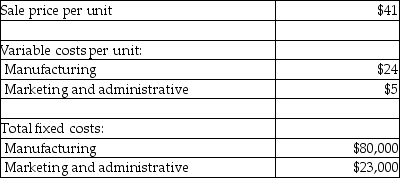

Widget Inc. manufactures widgets. The company has the capacity to produce 100,000 widgets per year, but it currently produces and sells 75,000 widgets per year. The following information relates to current production:  If a special sales order is accepted for 8100 widgets at a price of $39 per unit, and fixed costs increase by $13,000, how would operating income be affected? (NOTE: Assume regular sales are not affected by the special order.)

If a special sales order is accepted for 8100 widgets at a price of $39 per unit, and fixed costs increase by $13,000, how would operating income be affected? (NOTE: Assume regular sales are not affected by the special order.)

Definitions:

Total Fixed Costs

The sum of all costs that remain constant regardless of the level of production or output in a business.

Recession

A period of declining real GDP, accompanied by lower real income and higher unemployment.

Average Fixed Cost

The fixed expenses of a business spread out over the total number of units produced, decreasing as production increases.

Total Revenues

The total income generated by a firm from its sales activity, calculated by multiplying the selling price by the quantity sold.

Q48: When a merchandiser prepares a contribution margin

Q109: Lie Around Furniture manufactures two products: Couches

Q123: Which of the following alternatives reflect the

Q161: When setting prices, managers need to consider

Q172: Which of the following would be a

Q175: If unit sales prices, unit variable costs

Q177: By multiplying _ and then subtracting fixed

Q192: Assume the following amounts: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3059/.jpg" alt="Assume

Q219: Special orders increase income if the revenue

Q232: If inventory has declined, operating income will