Victoria Technologies makes a part used in the manufacture of digital cameras. Management is

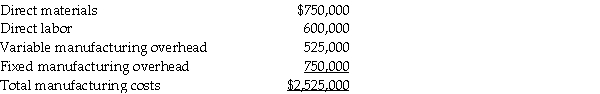

considering whether to continue manufacturing the part, or to buy the part from an outside source at a cost of $24.00 per part. Victoria Technologies needs 60,000 parts per year. The cost of manufacturing 60,000 parts is computed as follows:

If Victoria Technologies buys the part, it would pay $.60 per unit to transport the parts to its manufacturing plant. Purchasing the part from an outside source would enable the company to avoid 50% of fixed manufacturing overhead costs. Victoria Technologies' factory space freed up by purchasing the part from an outside supplier could be used to manufacture another product with a contribution margin of $70,000.

If Victoria Technologies buys the part, it would pay $.60 per unit to transport the parts to its manufacturing plant. Purchasing the part from an outside source would enable the company to avoid 50% of fixed manufacturing overhead costs. Victoria Technologies' factory space freed up by purchasing the part from an outside supplier could be used to manufacture another product with a contribution margin of $70,000.

Prepare an analysis to show which alternative makes the best use of Victoria Technologies' factory space:

1)Make the part

2)Buy the part and leave facilities idle

3)Buy the part and use facilities to make another product

Definitions:

State And Local Governments

The subdivisions of the federal government with their own specific powers and responsibilities, managing local affairs and providing public services.

Higher Interest Rate

An increased cost of borrowing money reflected in the percentage charged on the principal amount by lenders to borrowers.

Financially Shaky Corporations

Companies that are experiencing financial instability or distress, potentially leading to increased risk for investors and creditors.

Financial Intermediaries

Institutions that act as middlemen between savers and borrowers, facilitating the flow of funds in the financial system, such as banks and investment companies.

Q6: Richland Enterprises has budgeted the following amounts

Q8: The accounting department in a convenience store

Q14: Corny and Sweet grows and sells sweet

Q85: The master budget is the set of

Q91: Sales territories, such as geographic areas within

Q95: Slamburger's sells four cheeseburgers for every two

Q147: The Halpert Group produces a single product

Q209: The _ of the balanced scorecard focuses

Q211: If both fixed expenses and the selling

Q226: Beasley Company currently sells its products for