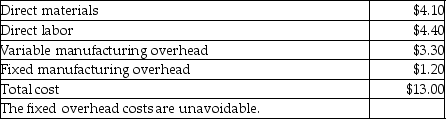

Cruise Company produces a part that is used in the manufacture of one of its products. The unit manufacturing costs of this part, assuming a production level of 6300 units, are as follows:  Assume Cruise Company can purchase 6300 units of the part from Suri Company for $14.30 each, and the facilities currently used to make the part could be used to manufacture 6300 units of another product that would have an $9 per unit contribution margin. If no additional fixed costs would be incurred, what should Cruise Company do?

Assume Cruise Company can purchase 6300 units of the part from Suri Company for $14.30 each, and the facilities currently used to make the part could be used to manufacture 6300 units of another product that would have an $9 per unit contribution margin. If no additional fixed costs would be incurred, what should Cruise Company do?

Definitions:

Absorption Costing

A technique in accounting that rolls all manufacturing expenses including direct material costs, direct labor, and every overhead, regardless if fixed or variable, into the overall cost of a product.

Unit Product Cost

The overall expense involved in creating one unit of a product, encompassing direct materials, direct labor, and distributed overhead costs.

Absorption Costing

An accounting method that includes all manufacturing costs (both variable and fixed) in the cost of a product.

Variable Costing

An accounting method that includes only variable costs in product cost calculations and treats fixed costs as period costs.

Q65: Mission Company has three product lines: D,

Q72: Assume the Hiking Shoes division of the

Q121: Ocelot Corporation had the following results last

Q148: Timber Run Company has prepared the following

Q155: On the direct labor budget, the total

Q197: Label each item below as relevant or

Q201: Gabe Industries sells two products, Basic models

Q240: The lowest possible operating leverage factor for

Q252: Martin Enterprises has a predicted operating income

Q253: Which of the following is relevant when