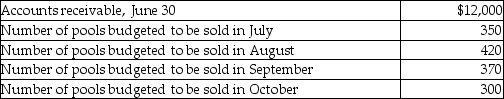

The Alec Corporation sells inflatable pools. On June 30, there were 105 pools in ending inventory, and accounts receivable had a balance of $12,000. Sales of inflatable pools (in units)have been budgeted at the following levels for the upcoming months:

The company has a policy that the ending inventory of inflatable pools should be equal to 30% of the number of pools to be sold in the following month. The Outdoor Leisure Store sells the inflatable pools for $100 each. The company's collection history shows that 30% of the sales in a month are paid for by customers in the month of sale, while the remainder is collected in the following month.

The company has a policy that the ending inventory of inflatable pools should be equal to 30% of the number of pools to be sold in the following month. The Outdoor Leisure Store sells the inflatable pools for $100 each. The company's collection history shows that 30% of the sales in a month are paid for by customers in the month of sale, while the remainder is collected in the following month.

Required:

a. Prepare a merchandise purchases budget showing how many pools should be purchased in each of the months including July, August, and September.

b. Prepare a cash collections budget for each of the months including July, August, and September.

Definitions:

Depreciation

The accounting process of allocating the cost of a tangible asset over its useful life, reflecting wear and tear, age, or obsolescence.

Net Working Capital

The difference between a company's current assets and its current liabilities, indicating the short-term liquidity position.

Tax Rate

The rate designated by the state to collect taxes from the profits or income of individuals or firms.

Profit Margin

A measure of profitability calculated as net income divided by revenues.

Q32: A favorable flexible budget variance for variable

Q51: Happy Helpers Maid Service is calculating its

Q53: Superior Corporation reports the following standards for

Q58: Network Enterprises incurred actual fixed manufacturing overhead

Q76: The type of standard that expects no

Q112: The Armstrong Corporation developed a flexible budget

Q119: Most companies use _ when the lower

Q133: Product differentiation allows companies to become more

Q191: The sales budget must be prepared after

Q205: The Rainy Division of Seattle Corporation reported