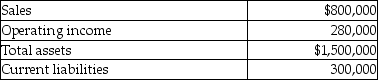

The Box Manufacturing Division of the Allied Paper Company reported the following results from the past year. Shareholders require a return of 7%. Management calculated a weighted-average cost of capital (WACC) of 3%. Allied's corporate tax rate is 35%.  What is the division's Residual Income (RI) ?

What is the division's Residual Income (RI) ?

Definitions:

Nucor's Profit-Sharing Program

A compensation scheme implemented by the steel company Nucor, designed to share a portion of profits with employees, thereby aligning their interests with the success of the company.

Steel Produced

The quantity of steel that has been manufactured and processed from raw materials.

Skill-Based Pay Programs

Compensation systems that pay employees based on their skills, expertise, and the variety of tasks they can perform, rather than their job title or position.

Job-Related Skills

Specific skills and capabilities that enhance an individual’s performance in their current or future employment roles.

Q82: Bookworm Publishers publishes books and they have

Q92: Assume the Hiking Shoes division of the

Q105: How is the fixed overhead budget variance

Q116: Harvey Automobiles uses a standard part in

Q118: The _ budget is a component in

Q147: Closing the variances to Cost of Goods

Q155: The Crystal Company uses straight-line depreciation and

Q164: Which of the following budgets is the

Q181: Which of the following is a disadvantage

Q227: Everyone Deserves to Smile mobile dentist office