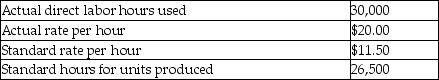

The following information describes a company's usage of direct labor in a recent period:  How much is the direct labor efficiency variance?

How much is the direct labor efficiency variance?

Definitions:

Straight-Line Method

A depreciation technique that allocates an equal amount of depreciation expense for a tangible asset over each year of its useful life.

Units-Of-Production

Units-of-production is a method of depreciation that allocates the cost of an asset over its useful life based on the number of units it produces, reflecting wear and use more accurately.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value due to use and time.

Salvage Value

The predicted sale value of an asset at the end of its operational life.

Q42: Percy Corporation sells a unit of its

Q85: What would a project's profitability index be

Q97: On the statement of cash flows, which

Q107: Hushovd Iron Works has collected the following

Q166: Jennifer recently earned a degree in accounting

Q168: Pyne Corporation's actual output for a period

Q180: If the Standard Quantity Allowed (SQA)for direct

Q198: The "rate of return that makes the

Q229: A flexible budget is a budget prepared

Q238: A rate variance for direct labor measures