Solve the following two cases (the cases are independent).

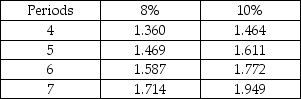

Future Value of $1

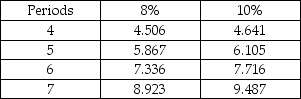

Future Value of Annuity of $1

Future Value of Annuity of $1

a. If you invest $5,000 today at 10% interest, what is the value of the investment at the end of 5 years?

a. If you invest $5,000 today at 10% interest, what is the value of the investment at the end of 5 years?

b. If you invest $1,200 at the end of each of the next 5 years and the investment earns 10% interest, what is the value of the investment at the end of 5 years?

Definitions:

Housing Prices

denote the value assigned to residential properties and homes, which fluctuate based on factors like location, demand, economic conditions, and interest rates.

Housing Bubble

An economic condition characterized by rapid increases in the valuations of real property until they reach unsustainable levels followed by a sharp decline.

Real Terms

Values adjusted for inflation, reflecting the actual purchasing power.

Behavioral Economics

The study of psychology as it relates to the economic decision-making processes of individuals and institutions.

Q11: Cleveland Cove Enterprises is evaluating the purchase

Q15: Use the direct method of cash flows

Q25: Capital budgeting predictions must consider factors such

Q26: Regarding capital rationing decisions for capital assets,

Q47: The residual value is considered in a

Q86: Calculating interest on the principal and on

Q101: The four perspectives of the balanced scorecard

Q118: The Amos Corporation reported the following income

Q126: A credit balance means that a variance

Q185: Raw material, ruined through mistakes during production,