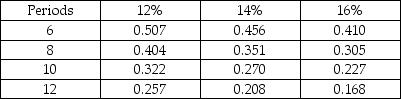

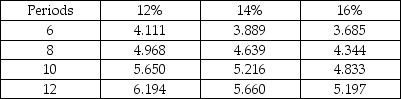

Byer, a plastics processor, is considering the purchase of a high-speed extruder as one option. The new extruder would cost $47,000 and would have a residual value of $5000 at the end of its 6-year life. The annual operating expenses of the new extruder would be $4000. The other option that Byer has is to rebuild its existing extruder. The rebuilding would require an investment of $40,000 and would extend the life of the existing extruder by 6 years. The existing extruder has annual operating costs of $11,000 per year and does not have a residual value. Byer's discount rate is 12%. Using net present value analysis, which option is the better option and by how much? Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

Definitions:

Slack Adjuster

A device in a braking system used for adjusting the brakes to compensate for wear.

Service Diaphragm

A flexible membrane in a device or pump that moves in response to pressure changes, used in various applications including brakes.

Treadle Valve

A treadle valve regulates air pressure in a pneumatic system, often found in heavy vehicles like trucks and buses, controlling braking force by the amount of pressure applied by the driver's foot.

Metered Out

In fluid dynamics and pneumatics, refers to the controlled release or distribution of a fluid at a measured rate from a system.

Q5: The variable overhead rate variance tells managers

Q21: The _ balance sheets displays only percentages.<br>A)comparative<br>B)account

Q43: The formula to compute accounts receivable turnover

Q84: (Net present value table required)Windy Industries, in

Q123: There are several reasons an organization might

Q124: A company uses the indirect method to

Q138: Dandy's Fun Park is evaluating the purchase

Q161: The discounted cash flow methods for capital

Q183: A series of equal payments or deposits

Q188: Tommy's Toys produces two types of toys: