Louise owns a golf course and wants to add some computers to the lounge. The computers would cost $14,000 and would have a 3 year life and no residual value. Louise expects the computers to generate $4,000 annual cash inflows for 3 years. The discount rate is 8%. What is the net present value of the investment?

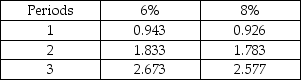

Present Value of Annuity of $1

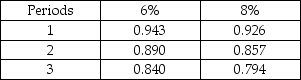

Present Value of $1

Present Value of $1

Definitions:

Kotter's Final Step

In Kotter's 8-step process of leading change, the final step involves anchoring new approaches in the culture for lasting change.

Organizational Structure

The system of tasks, workflows, reporting relationships, and communication channels that link together diverse parts of an organization.

Behavior In Organizations

Refers to the actions and interactions of individuals within an organizational setting, influenced by the organization's culture, policies, and structure.

Structural Intervention

A method used in organizations to improve effectiveness through changes in policies, structures, and procedures.

Q1: When a company has found an innovative

Q40: If a company uses the indirect method

Q50: The ability of a company to collect

Q61: A cash flow statement shows $29,000 from

Q69: The balance sheet for Bostick Corporation follows:

Q69: An accurate description of horizontal analysis would

Q73: A company's inventory account increased $28,000 and

Q89: A company uses sugar in producing its

Q99: The Global Reporting Initiative has developed a

Q237: Aiken Manufacturing gathered the following flexible budget