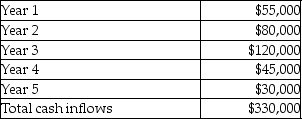

Landrum Corporation is considering investing in specialized equipment costing $260,000. The equipment has a useful life of 5 years and a residual value of $15,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are:  Landrum Corporation's required rate of return on investments is 20%.

Landrum Corporation's required rate of return on investments is 20%.

What is the accounting rate of return on the investment?

Definitions:

Profit

The financial gain obtained when the amount earned from a business activity exceeds the expenses, costs, and taxes involved in sustaining the activity.

Selling Price

The amount at which an item or service is sold to the customer.

Outstanding Balance

The amount of money owed on a loan or credit account that has not yet been repaid.

Invoice

A document indicating a transaction between a buyer and a seller, listing the goods or services provided along with their prices and the total amount due.

Q36: For purposes of the statement of cash

Q60: A standard cost income statement shows cost

Q99: In performing a vertical analysis of a

Q116: Which of the following situations may lead

Q126: A credit balance means that a variance

Q131: Up-to-date standard costs provide a benchmark by

Q146: A company uses the direct method to

Q175: The unemployment rate is high in the

Q183: Selected information about the Thomas Trucks Company

Q197: The managerial accountant at Matheson Tool Company