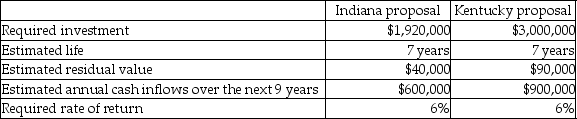

O'Mally Department Stores is considering two possible expansion plans. One proposal involves opening 5 stores in Indiana at the cost of $1,920,000. Under the other proposal, the company would focus on Kentucky and open 6 stores at a cost of $3,000,000. The following information is available:  The accounting rate of return for the Kentucky proposal is closest to (Round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, X.XX%.)

The accounting rate of return for the Kentucky proposal is closest to (Round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, X.XX%.)

Definitions:

Top-Down Analysis

An investment strategy that starts with macroeconomic analysis to identify promising sectors or industries before selecting specific stocks.

Global Economy

This term refers to the interconnected worldwide economic activities that influence the production, distribution, and consumption of goods and services.

Firm's Prospects

This involves the future outlook or potential for success and growth of a company, often considered by investors when evaluating investment opportunities.

Consumer Confidence Index

A statistical measurement of consumers' overall perceptions of the economic environment and their willingness to spend money.

Q7: Assuming an interest rate of 14%, if

Q17: The Cookies Bakery Company managerial accountant considers

Q35: Presented are the income statements of Little

Q59: Customer satisfaction, operational efficiency, employee excellence, and

Q70: The purchase of inventory would be considered

Q98: A company acquires its own stock to

Q123: Flexible budgets are budgets that summarize cost

Q153: Cleveland Cove Enterprises is evaluating the purchase

Q191: When a company uses the indirect method

Q192: Which of the following would appear on