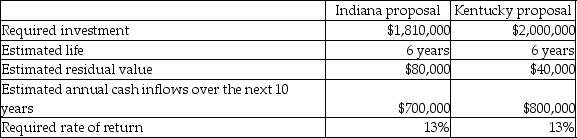

O'Mally Department Stores is considering two possible expansion plans. One proposal involves opening 5 stores in Indiana at the cost of $1,810,000. Under the other proposal, the company would focus on Kentucky and open 6 stores at a cost of $2,000,000. The following information is available:  The accounting rate of return for the Indiana proposal is closest to (Round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, X.XX%.)

The accounting rate of return for the Indiana proposal is closest to (Round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, X.XX%.)

Definitions:

Q1: An outflow of cash from an investing

Q15: Jack Corporation uses horizontal analysis to compare

Q47: The residual value is considered in a

Q116: On a cash flow statement prepared using

Q149: Trend percentages are not a form of

Q163: Which of the following items is NOT

Q174: A favorable volume variance for sales revenue

Q179: Residual income is defined as the difference

Q187: On the line in front of each

Q253: DOT Safety Systems manufactures motorcycle helmets. What