Solve the following two cases (the cases are independent).

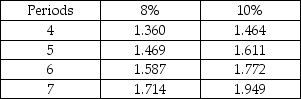

Future Value of $1

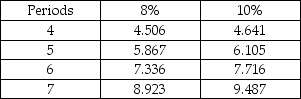

Future Value of Annuity of $1

Future Value of Annuity of $1

a. If you invest $5,000 today at 10% interest, what is the value of the investment at the end of 5 years?

a. If you invest $5,000 today at 10% interest, what is the value of the investment at the end of 5 years?

b. If you invest $1,200 at the end of each of the next 5 years and the investment earns 10% interest, what is the value of the investment at the end of 5 years?

Definitions:

Absorption Costing

An accounting approach that factors in every manufacturing expense, like direct materials, direct labor, and both types of overhead (variable and fixed), into the product pricing.

Variable Costing

A costing method in which all variable manufacturing costs are included as inventory costs, while fixed manufacturing overhead is treated as an expense in the period incurred.

External Reporting

External reporting involves the preparation and presentation of financial statements and other reports by a company to provide financial and operational information to external stakeholders, such as investors, creditors, and regulatory agencies.

Absorption Costing

An accounting method that includes all manufacturing costs in the cost of a product.

Q15: Vino Winery is considering the purchase of

Q44: The Berwin Company established a master budget

Q68: Companies may only use one capital budgeting

Q81: Environmental sustainability should only be the concern

Q90: The following data relates to Logan Electric

Q152: If the accounting rate of return exceeds

Q154: The profitability index is calculated by dividing

Q172: The Pantry Vending Machine Company is looking

Q174: A favorable volume variance for sales revenue

Q192: Which of the following would appear on