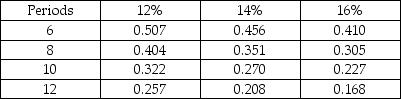

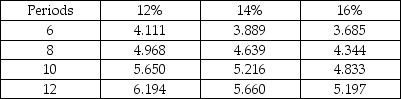

Byer, a plastics processor, is considering the purchase of a high-speed extruder as one option. The new extruder would cost $47,000 and would have a residual value of $5000 at the end of its 6-year life. The annual operating expenses of the new extruder would be $4000. The other option that Byer has is to rebuild its existing extruder. The rebuilding would require an investment of $40,000 and would extend the life of the existing extruder by 6 years. The existing extruder has annual operating costs of $11,000 per year and does not have a residual value. Byer's discount rate is 12%. Using net present value analysis, which option is the better option and by how much? Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

Definitions:

Refreezing Step

The final stage in the Lewin's change management model, where new behaviors or changes are solidified into the organization's culture and practices.

Environmental

Relating to the natural surroundings and conditions in which people, plants, and animals live.

Technological Changes

Refers to advancements and innovations in technology that impact society, businesses, and individual practices by introducing new tools, processes, or methods.

Seven Major Life Changes

Loss, separation, relocation, a change in relationship, a change in direction, a change in health, and personal growth.

Q25: Money borrowed for a mortgage would be

Q77: The hurdle rate is the length of

Q98: A company acquires its own stock to

Q101: The profitability index is also known as<br>A)future

Q103: Matthew Corporation is adding a new product

Q129: An example of _ would include an

Q184: The Ranger Corporation data for the current

Q193: All four perspectives must always be included

Q210: The _ of the balanced scorecard focuses

Q213: The _ capital budgeting methods are based