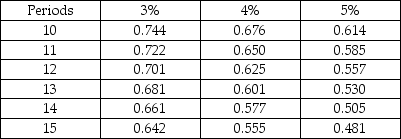

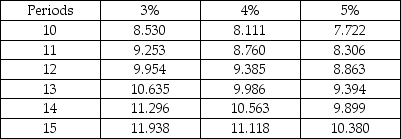

Westin Manufacturing is considering the purchase of a new machine to use in its packing department. The new machine will have an initial cost of $160,000, a useful life of 12 years and a $6000 residual value. Westin will realize $15,100 in annual savings for each of the machine's 12-year useful life. Given Westin's 5% required rate of return, the new machine will have a net present value (NPV) of: (Round any intermediary calculations and your final answer to the nearest dollar.) Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

Definitions:

Fight or Flight

A physiological response to perceived harmful events, attacks, or threats to survival, preparing the body for defensive or evasive action.

Epinephrine

Also known as adrenaline, a hormone and a neurotransmitter that increases heart rate, muscle strength, blood pressure, and sugar metabolism.

Growth Hormone

A substance in humans and other animals that promotes growth, cell reproduction, and the healing of cells.

Antidiuretic Hormone

A hormone released by the pituitary gland that helps regulate the balance of water in the body by reducing the amount of water excreted by the kidneys.

Q27: How is the variable overhead efficiency variance

Q37: The following data relate to Sorrentino Corporation

Q68: Companies may only use one capital budgeting

Q81: Environmental sustainability should only be the concern

Q113: A quantity (efficiency)variance for production inputs (materials

Q122: Senseman Company has three potential projects from

Q130: An unfavorable flexible budget variance for variable

Q135: The difference between the actual revenues and

Q191: How would you describe the Standard Hours

Q198: The "rate of return that makes the