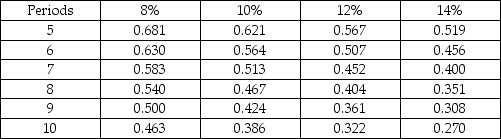

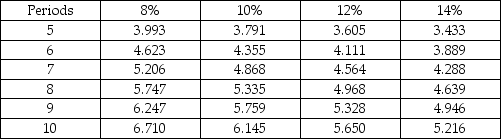

Karpets Industries is investing in a new high-speed loom for weaving its rugs and carpets. The new loom will have a useful life of 6 years and cost $70,000. The loom's residual value is $5000. Assume that Karpets requires a return of 10% and that the loom will create annual cost savings of $17,450. What is the net present value (NPV) of the new loom? (Round any intermediary calculations and your final answer to the nearest dollar.) Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

Definitions:

Politically Distinct Groups

Groups identified by their specific political beliefs, ideologies, or affiliations, distinguishing them from other political entities.

Territory

An area of land under the jurisdiction of a ruler or state; in animal behavior, a region defended by an animal or group of animals against others.

Civil War

An internal conflict within a country between factions or regions, often involving a struggle for power, autonomy, or ideological differences.

Slavery

Is the ownership and control of people.

Q19: Simple interest means that interest is calculated

Q31: Which variance is directly impacted if a

Q34: Shaker Investments, a private investment holding company,

Q54: The standard cost of direct labor per

Q72: On the statement of cash flows, which

Q75: In what ways are the Net Present

Q145: A company reported the following amounts of

Q150: The statement of cash flows reflects cash

Q152: The balance in the _ is used

Q207: What will happen to the internal rate