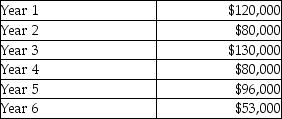

Sunny Days Corporation is deciding whether to automate one phase of its production process. The equipment has a six-year life and will cost $300,000. Projected net cash inflows from the equipment are as follows:  Sunny Days Corporation's hurdle rate is 10%.

Sunny Days Corporation's hurdle rate is 10%.

If Sunny Days Corporation decides to refurbish the equipment at a cost of $70,000 at the end of year 6, it could be used for one more year and would have a $50,000 residual value at the end of year 7. Assume the cash inflow in year 7 is $80,000. What is the NPV of just the refurbishment?

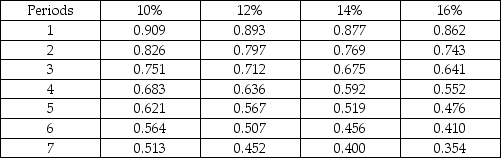

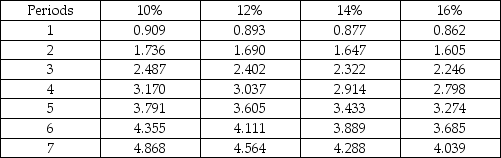

Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

Definitions:

Mercantilist Regulations

Economic policies and theories from the 16th to 18th centuries focusing on a nation's wealth accumulation through trade balance control, often through protective tariffs and government regulation of commerce.

Covenant Chain

Alliance formed in the 1670s between the English and the Iroquois nations.

Iroquois Confederacy

A coalition of Native American tribes primarily located in what is now New York State, historically known for their political union and influence.

Predestination

A theological doctrine that all events have been willed by God, particularly relating to the fate of the soul after death, found in various religious traditions.

Q2: Which of the following is a reason

Q45: The direct labor rate variance describes differences

Q71: Net income is used as the base

Q88: The inventory turnover ratio indicates how rapidly

Q92: Which of the following sections from the

Q98: A favorable direct labor efficiency variance and

Q146: An unfavorable direct labor rate variance indicates

Q146: A company uses the direct method to

Q190: Assuming an interest rate of 14%, the

Q228: Steep Enterprises machines heavy-duty brake rotors that