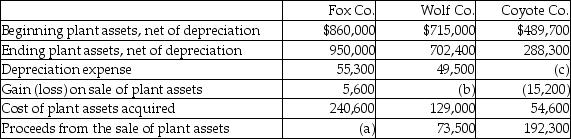

The following information is available for three companies. The information relates to the companies' plant assets. For each of the companies, determine the unknown amounts.

Definitions:

Regressive Tax

A tax system where the tax rate decreases as the taxable amount increases, imposing a heavier burden on lower-income individuals.

Proportional Tax

A tax system where the tax rate is fixed and applied uniformly to all taxpayers, regardless of income level.

Marginal Tax Rate

The tax rate applied to the next dollar of taxable income, indicating how much tax will be paid on an additional dollar earned.

Average Tax Rate

The fraction of total income that is paid as taxes, calculated by dividing the total amount of tax paid by the total income.

Q9: Vertical analysis would rarely be performed on

Q12: If a company recognizes variances at the

Q21: The cost to install equipment to reduce

Q42: The above diagram shows a balance sheet

Q61: The G4 framework is organized around three

Q64: The managerial accountant at Sailboat World compiles

Q74: The Hummel Corporation reported the following income

Q141: Capital investments do not typically require large

Q159: Paying cash dividends would be<br>A)a cash outflow

Q161: To follow is selected information about the