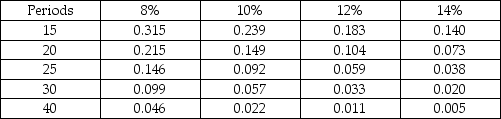

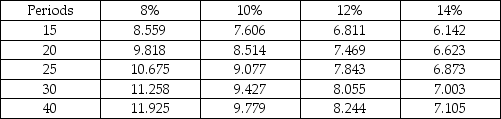

(Net present value table required) Windy Industries, in Chicago, plans to take advantage of the winds blowing in from Lake Michigan. Windy is developing a project to install a wind turbine that would generate electricity and reduce energy costs. The turbine would have an initial cost of $550,000 and would provide a net cost savings of $62,000 per year. The turbine will have a life of 25 years. If Windy assigns a discount rate of 10% to this project, what is the net present value (NPV) of the wind turbine?

Present Value of $1 Present Value of Annuity of $1

Present Value of Annuity of $1

Definitions:

Graduate Students

Individuals who have completed an undergraduate degree and are pursuing further studies at a masters or doctoral level.

Undergraduate Students

Individuals enrolled in an undergraduate program at colleges or universities, aiming to earn an associate or bachelor's degree.

Significant Difference

A significant difference refers to a statistically meaningful difference between two groups, suggesting the observed effect is likely not due to chance alone.

Graduate Students

Individuals who have completed an undergraduate degree and are pursuing further education at the post-graduate level, such as a master's or doctoral degree.

Q1: A house costs $138 000. It is

Q8: What are the four financial statements that

Q18: A businessman wants to buy a truck.

Q25: Together, CLERP 9 and the ASX Good

Q50: Which of the following organizations has developed

Q60: A factory owner wants his workers to

Q85: The amount of your original loan is

Q101: Common Paper Supply produces paper cups for

Q116: On a cash flow statement prepared using

Q170: The _ section from the statement of