Use the information for the question(s) below.

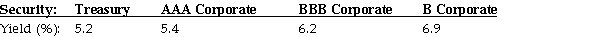

-A firm issues 10-year bonds with a coupon rate of 6.5%, paid semi-annually. The credit spread for this firm's 10-year debt is 0.8%. New 10-year Treasury bonds are being issued at par with a coupon rate of 5%. What should the price of the firm's outstanding 10-year bonds be per $100 of face value?

Definitions:

Intrinsic Motivation

The internal drive to perform a task due to the inherent satisfaction or interest in the task itself, rather than external rewards or pressures.

Sales Employees

Individuals engaged in promoting and selling products or services for a company.

Straight Commission Plan

A compensation plan based on a percentage of sales.

Percentage of Sales

A financial ratio that compares a company's expenses or profits to its total sales, often used to analyze efficiency or profitability.

Q16: A company intends to install new management

Q24: How do the growing perpetuity results differ

Q26: The owners of a chain of fast-food

Q27: Which of the following investments has a

Q48: Can we apply the growing perpetuity equation

Q54: You are considering adding a microbrewery onto

Q55: A share is bought for $20.00 and

Q72: Allen Company bought a new copy machine

Q80: What is the future value (FV)of $60

Q90: When using equivalent annual annuities to compare