Use the information for the question(s) below.

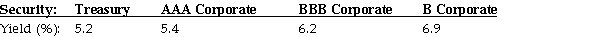

-A firm issues 20-year bonds with a coupon rate of 4.8%, paid semi-annually. The credit spread for this firm's 20-year debt is 1.2%. New 20-year Treasury bonds are being issued at par with a coupon rate of 4.6%. What should the price of the firm's outstanding 20-year bonds be if their face value is $1 000?

Definitions:

Prompt Payment Discount

A discount offered to customers for paying their bills promptly, usually within a specified time frame to encourage faster payment.

Terms of Sale

The conditions under which a seller will complete a sale, typically outlining payment terms, delivery times, and quality expectations.

Prompt Payment Discount

A discount offered by sellers to buyers for paying their invoices early.

Liable

Legally responsible or obligated.

Q2: Suppose you bought a $58 share a

Q28: Rational investors are not averse to moderate

Q30: What is the term for the applicable

Q39: The opportunity cost of capital is the

Q61: Spacefood Products will pay a dividend of

Q65: A small foundry agrees to pay $250

Q74: Bonds with a high risk of default

Q80: Companies that sell household products and food

Q87: In which of the following situations would

Q89: What is the diversification achieved by an