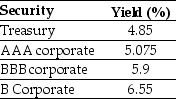

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the BBB corporate bond is closest to:

Definitions:

High Variance

Refers to a wide range of outcomes or values in a set of data, indicating a high level of volatility or risk.

M2 Measure

A broad measure of a country's money supply that includes cash, checking deposits, and easily convertible near money.

Modigliani and Miller

Two economists who introduced groundbreaking theories on the irrelevance of capital structure for a company's value and the dividend policy irrelevance in an ideal market.

Total Excess

The amount by which the total returns on an investment exceed the benchmark or guaranteed returns.

Q14: What is the implied assumption about interest

Q24: A graphic designer needs a laptop for

Q35: Refer to the balance sheet above. If

Q41: The credit spread of the BBB corporate

Q44: Avril Synchronistics will pay a dividend of

Q63: Fortescue Mining had realised returns of 5%,

Q73: Why should interest rates be generally positive?

Q86: Volatility a reasonable measure of risk when

Q98: The S&P 500 index traditionally is a(n)_

Q101: Refer to the income statement above. Luther's