Use the information for the question(s) below.

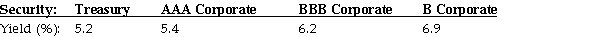

-A firm issues 10-year bonds with a coupon rate of 6.5%, paid semi-annually. The credit spread for this firm's 10-year debt is 0.8%. New 10-year Treasury bonds are being issued at par with a coupon rate of 5%. What should the price of the firm's outstanding 10-year bonds be per $100 of face value?

Definitions:

Variable Substitution

The process of replacing a variable in an equation or expression with a specific value.

Exponentiation

A mathematical operation involving two numbers, the base and the exponent, where the base is multiplied by itself as many times as indicated by the exponent.

System of Equations

A set of two or more equations with the same set of unknowns, which are solved simultaneously.

Variable Substitution

Replacing a variable in an equation or expression with its corresponding value.

Q7: The price (expressed as a percentage of

Q21: The weight of ANZ in your portfolio

Q23: If interest rates are 4.5% and inflation

Q28: A company has a current share price

Q36: Why is the personal decision a financial

Q40: Visby Rides, a limousine hire company, is

Q43: The price of BHP is $40 per

Q64: If the exchange rates, after fees, in

Q66: The risk that inflation rates are likely

Q96: Investments in Treasury bills have historically witnessed