Use the information for the question(s) below.

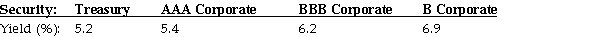

-A firm issues 20-year bonds with a coupon rate of 4.8%, paid semi-annually. The credit spread for this firm's 20-year debt is 1.2%. New 20-year Treasury bonds are being issued at par with a coupon rate of 4.6%. What should the price of the firm's outstanding 20-year bonds be if their face value is $1 000?

Definitions:

Nervous Systems

The nervous system is the complex network of nerve tissue that controls activities within the body by transmitting electrical and chemical signals between different body parts.

Essential

Absolutely necessary or extremely important for a particular process, function, or survival.

Life

A characteristic that distinguishes physical entities with biological processes, such as signaling and self-sustaining processes, from those that do not.

Bilateral Symmetry

Body plan in which organs or parts present on both sides of the body are mirror images in appearance. For example, the hands are bilaterally symmetrical, whereas the heart is not.

Q19: You own 1 050 shares of Ausback

Q21: Assuming that your capital is constrained, which

Q26: What will be the effect on the

Q38: Assuming you pay the points and borrow

Q47: A consumer good company is developing a

Q56: If the Reserve Bank was to change

Q57: The face value of the bond.

Q66: Is it possible to learn the true

Q71: An investor has the opportunity to buy

Q106: Under what situation can the net present