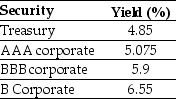

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The price (expressed as a percentage of the face value) of a one-year, zero-coupon, corporate bond with a BBB rating is closest to:

Definitions:

Dominant Firms

Companies that have a major share of sales in a specific market, significantly influencing that market's dynamics.

New Firms

Newly established businesses entering the market, often bringing innovation or increasing competition in their industry segment.

Creative Destruction

A concept in economics where new innovation leads to the obliteration of older industries or ways of doing things, driving economic development.

Concentrated Industries

Industries where a few companies dominate the market share, resulting in less competition and potentially higher prices for consumers.

Q2: If money is invested at 8% per

Q6: What is the yield to maturity of

Q7: A linear regression to estimate the relation

Q15: Which of the following statements is FALSE?<br>A)Two

Q18: You can evaluate alternative projects with different

Q26: Suppose you bought a $62 share a

Q27: Bonza Corporation generated free cash flow of

Q54: A backhoe can dig 175 metre of

Q79: Inflation is calculated as the rate of

Q98: One of the main obstacles in cost-benefit