Use the information for the question(s) below.

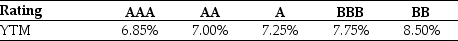

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing 10-year bonds with a face value of $1 000 and a coupon rate of 7.0% (annual payments) . The following table summarises the YTM for similar 10-year corporate bonds of various credit ratings:

-Assuming that Luther's bonds receive a BBB rating, the price of the bonds will be closest to:

Definitions:

Research Participants

Research Participants are individuals who take part in scientific studies, providing data through their responses or behavior for analysis.

Explicit Sexual Content

Media or material that shows or describes sexual acts in a direct and clear way, intended for adult audiences.

Word-Completion Task

A cognitive test used to measure automatic processes and access to specific types of information in memory through the completion of unfinished words.

Control Group

In an experiment, the group that does not receive the experimental treatment, used as a baseline to measure how the other tested groups compare.

Q2: Chittenden Enterprises has 632 million shares on

Q7: The above screen shot from Google Finance

Q12: On average, shares have delivered lower returns

Q24: A company issues a 10-year bond at

Q33: An annuity pays $12 per year for

Q44: The cash flow effect from a change

Q44: Gooringa Oil announces that an exploratory well

Q63: Which of the following statements is FALSE?<br>A)The

Q68: The volatility of Woolworth's share price is

Q93: An 7% APR with quarterly compounding is