Use the information for the question(s) below.

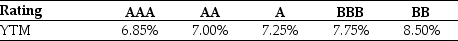

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing 10-year bonds with a face value of $1 000 and a coupon rate of 7.0% (annual payments) . The following table summarises the YTM for similar 10-year corporate bonds of various credit ratings:

-Assuming that Luther's bonds receive a AAA rating, the price of the bonds will be closest to:

Definitions:

Bearer Paper

A negotiable instrument or securities that are payable to the holder or the person possessing the document.

Holder in Due Course

A party who has acquired a negotiable instrument in good faith and for value, and thus has certain rights to collect the instrument free of many defenses.

Negotiated

Involves parties coming together to discuss and settle on the terms of an agreement, contract, or settlement through dialogue and compromise.

Notice

A formal communication or announcement, often legal in nature, that informs a person or entity about an action, decision, or condition that affects their rights or duties.

Q7: The above screen shot from Google Finance

Q12: How does a firm select the dates

Q17: An advantage of the 'valuation multiple method'

Q30: How can we make a financial decision

Q30: Consider a zero-coupon bond with a $1

Q35: The above table shows the yields to

Q39: The opportunity cost of capital is the

Q51: Assuming the appropriate YTM on the Sisyphean

Q67: You are interested in purchasing a new

Q72: Is it accurate to state that as