Use the information for the question(s) below.

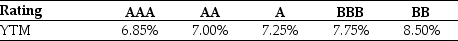

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing 10-year bonds with a face value of $1 000 and a coupon rate of 7.0% (annual payments) . The following table summarises the YTM for similar 10-year corporate bonds of various credit ratings:

-Assuming that Luther's bonds receive a AAA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to:

Definitions:

Adjustment

The process of modifying something to achieve a desired outcome, often used in the context of economic policies, mechanisms, or personal changes.

Equilibrium Price

The price at which the quantity of a product offered is equal to the quantity of the product in demand.

Government

The organization, or system of governance, that exercises authority and performs the functions of governing a political state or community.

Market Price

The present cost at which a service or asset is available for purchase or sale.

Q4: Jumbuck Exploration has a current stock price

Q7: The price (expressed as a percentage of

Q17: Consider the above statement of cash flows.

Q36: The effective annual rate (EAR)for a savings

Q44: Which of the following best shows the

Q69: Assuming that your capital is constrained, which

Q80: A brewer is launching a new product-brewed

Q80: Fortescue Mining had realised returns of 10%,

Q105: The highest effective rate of return you

Q111: The Net Present Value rule implies that