Use the figure for the question(s) below.

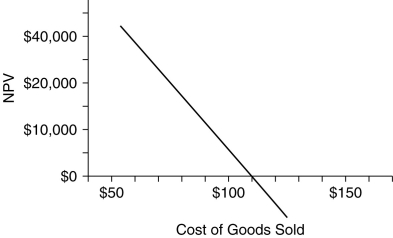

-A maker of kitchenware is planning on selling a new chef-quality kitchen knife. The manufacturer expects to sell 1.6 million knives at a price of $120 each. These knives cost $80 each to produce. Selling, general, and administrative (SG&A) expenses are $500 000. The machinery required to produce the knives cost $1.4 million, depreciated by straight-line depreciation over five years. The maker determines that the EBIT break-even point for units sold and sale price is less than these estimates and that the EBIT break-even point for costs per unit, SG&A, and depreciation are greater than these estimates, so decides to go ahead with manufacturing the knife. Was this the correct decision?

Definitions:

Sigmund Freud

Originating from Austria, he was a pioneering neurologist who established psychoanalysis as a way to treat mental health issues through dialogue with a psychoanalyst.

Visual Memory

The ability to remember or recall information such as objects, symbols, or pictures previously seen.

Partial Report Method

A memory recall technique where participants are asked to recall a specific subset of items from a briefly presented array.

Sensory Memory

The shortest-term element of memory, it allows the retention of impressions of sensory information after the original stimuli have ended.

Q1: A house costs $138 000. It is

Q37: What is the implied assumption about interest

Q40: Gepps Cross Industries issues debt with a

Q53: Matilda Industries pays a dividend of $2.45

Q56: If the Reserve Bank was to change

Q73: A firm has a capital structure with

Q77: What is the diversification achieved by an

Q79: Which of the three costs-debt, preference share

Q86: Volatility a reasonable measure of risk when

Q96: Assume that your capital is constrained, so