Use the information for the question(s) below.

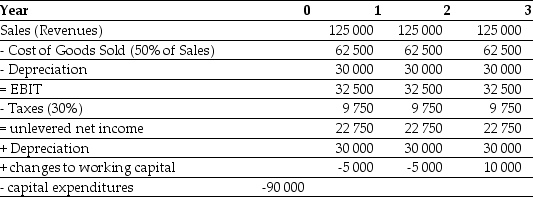

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-The free cash flow for the first year of Epiphany's project is closest to:

Definitions:

Data Structure

Organized ways of storing and organizing data in a computer so that it can be used efficiently, including arrays, linked lists, stacks, queues, trees, and graphs.

User-Defined

User-defined refers to features, functions, or elements customized or defined by the user, offering flexibility to tailor systems or applications to specific needs or preferences.

Module-Defined

A characteristic or feature that is specified or determined by a particular module in a software system or hardware device.

Predefined

Refers to something that has been defined or set in advance before being used or implemented.

Q11: A small business refits its store. The

Q26: Jeremy founded a company. He issues 200

Q26: The manufacturer of a brand of kitchen

Q31: A perpetuity has a PV of $32

Q42: Suppose you invest in 100 shares of

Q49: Suppose over the next year BHP has

Q77: When a firm is evaluating the purchase

Q87: Bear Inc.'s share price closed at $100,

Q91: As a firm increases its level of

Q95: CathFoods will release a new range of