Use the information for the question(s) below.

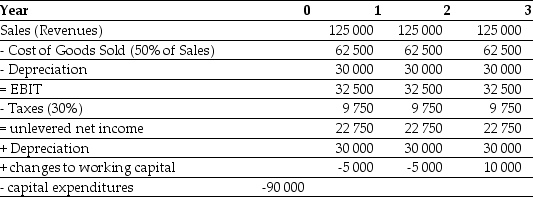

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

-A firm is considering changing their credit terms. It is estimated that this change would result in sales increasing by $1 000 000. This in turn would cause inventory to increase by $150 000, accounts receivable to increase by $100 000, and accounts payable to increase by $75 000. What is the firm's expected change in net working capital?

Definitions:

Q4: The market value of Fortescue's ordinary shares,

Q9: The change in net working capital from

Q21: Bonza Corporation generated free cash flow of

Q22: Consider a zero-coupon bond with a $1

Q24: The risk premium of a security is

Q34: Which of the following statements is FALSE?<br>A)The

Q38: You are considering purchasing a new home.

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3082/.jpg" alt=" The table above

Q60: A portfolio has 50% of its value

Q74: What is the decision criteria using the