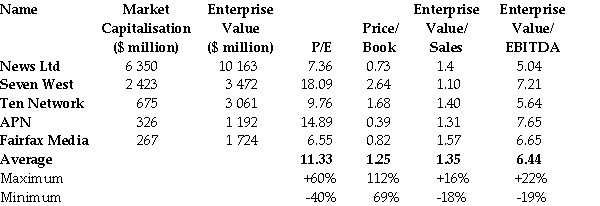

Use the table for the question(s) below.

-The table above shows the share prices and multiples for a number of firms in the media industry. Another media firm (not shown) had sales of $620 million, EBITDA of $84 million, excess cash of $66 million, $14 million of debt, and 120 million shares outstanding. If the average enterprise value to sales for comparable businesses is used, which of the following is the range of reasonable share price estimates?

Definitions:

Concise

Expressing or providing much information in a few words; clear and succinct.

Understandable

Relating to information or concepts being clear or easy enough to be comprehended or grasped by a person.

Population Characteristics

Attributes or features that describe the various aspects of a population.

Transfer Price

The price at which divisions of a company transact with each other, such as the trade of supplies or labor between departments.

Q6: Fortescue had realised returns of 10%, 25%,

Q7: Which of the following is an advantage

Q15: A pottery factory purchases a continuous belt

Q47: The Magnificent Corporation is expected to pay

Q48: The weight of FLT in your portfolio

Q51: A Xerox DocuColor photocopier costing $42 000

Q64: Prior to its maturity date, the price

Q69: Assuming that your capital is constrained, which

Q84: How does IPO pricing puzzle financial economists?<br>_<br>_

Q97: You are in the process of purchasing