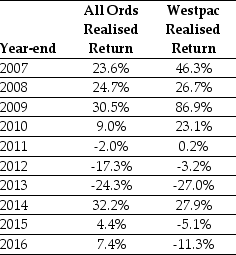

Use the table for the question(s) below.

Consider the following realised annual returns:

-The average annual return on the All Ords from 2007 to 2016 is closest to:

Definitions:

Writing Process

The sequence of steps involved in producing a written document, typically including planning, drafting, revising, and editing.

Main Idea

The central or most important point that an author wants to communicate to the reader.

Scope

The spectrum of data conveyed in communication, including its total duration and the extent of specifics offered.

Writing Process

The series of steps or stages involved in producing a written document, typically including prewriting, drafting, revising, editing, and publishing.

Q4: After examining the yield curve, what predictions

Q8: A firm has a market value of

Q17: The depreciation tax shield for the Sisyphean

Q18: The yield curve is typically<br>A)flat.<br>B)inverted.<br>C)downward sloping.<br>D)upward sloping.

Q22: The net present value (NPV)for project alpha

Q50: Which of the following statements is FALSE?<br>A)Because

Q56: Most practitioners would use net debt when

Q65: Holding everything else constant, an increase in

Q69: A company issues a callable (at par)20-year,

Q89: What is the diversification achieved by an