Use the table for the question(s) below.

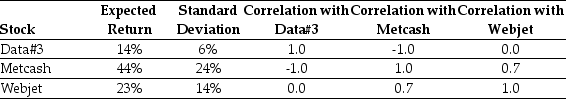

Consider the following expected returns, volatilities and correlations:

-The volatility of a portfolio that is equally invested in Data#3 and Metcash is closest to:

Definitions:

Present Value

The present value of a future amount of money or series of cash flows, calculated using a designated rate of return.

Guaranteed Amount

A specific sum assured to be paid, often in the context of insurance or investment products, regardless of variable conditions.

Lease Payments

Periodic payments made by a lessee to a lessor for the use of an asset.

Inventory Cost

The total cost incurred to acquire inventory and bring it to its current condition and location, including purchase prices, freight, and handling fees.

Q13: The firm mails dividend cheques to the

Q14: Verano Ltd has two business divisions -

Q25: Your firm is considering building a new

Q28: The standard deviation of the two assets

Q31: Green Motors expects a new hybrid-engine project

Q38: Tanner is choosing between two investment options.

Q43: The costs of IPO are very high

Q46: When different investment rules give conflicting answers,

Q54: The expected return of a portfolio that

Q63: Fortescue Mining had realised returns of 5%,