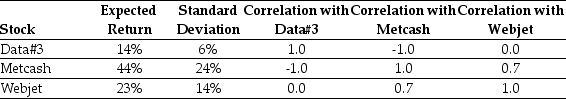

Use the table for the question(s) below.

Consider the following expected returns, volatilities and correlations:

-A share market comprises 5 000 shares of company A and 2 000 shares of company B. Assume the share prices for companies A and B are $20 and $35, respectively. What is the capitalisation of the market portfolio?

Definitions:

Transference

In psychotherapy, the process by which a patient transfers feelings towards an important individual onto the therapist.

Curative Process

The mechanisms and dynamics through which therapeutic interventions facilitate healing and psychological improvement.

Transference Neurosis

An emotional condition in psychoanalysis where feelings and desires originally associated with significant others are unconsciously redirected onto the therapist.

Therapy Sessions

Meetings between a therapist and a client where psychological issues are explored and treated through conversation and therapeutic techniques.

Q5: A firm that has trouble meeting its

Q26: Suppose you bought a $62 share a

Q29: Highlander Homes shares trade at $32 per

Q37: In an efficient market, investors will only

Q43: A small manufacturer that makes clothes pegs

Q58: Which of the following statements is FALSE

Q59: When a callable bond sells at a

Q71: A company issues a callable (at par)10-year,

Q94: Your estimate of the market risk premium

Q105: The A in the equation above represents<br>A)the