Use the table for the question(s) below.

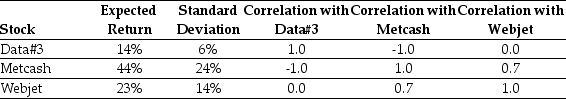

Consider the following expected returns, volatilities and correlations:

-A share market comprises 2 000 shares of company A and 2 000 shares of company B. The share prices for companies A and B are $20 and $10, respectively. What is the capitalisation of the market portfolio?

Definitions:

REM Sleep

REM sleep, or Rapid Eye Movement sleep, is a phase of sleep characterized by fast eye movements, vivid dreams, and increased brain activity.

N1 Sleep

The initial stage of non-REM sleep characterized by light sleep, from which a person can be easily awakened.

N2 Sleep

A stage of sleep within the non-REM cycle characterized by sleep spindles and K-complexes, marking a deeper sleep than N1 and preceding the deepest, N3 stage.

N3 Sleep

Third stage of non-REM sleep, characterized by deep sleep and the presence of delta waves in the brain, essential for restorative sleep.

Q7: The price (expressed as a percentage of

Q12: On a particular date, the above information

Q15: If WiseGuy Ltd uses the payback period

Q22: Highlander Homes shares trade at $35 per

Q33: Suppose a firm does not pay a

Q33: According to Truong, Partington, and Peat's 2004

Q35: Banco Industries expects sales to grow at

Q38: Common risk is also called 'correlated risk'.

Q97: Assume that in addition to 1.25 billion

Q99: A firm requires an investment of $20