Use the table for the question(s) below.

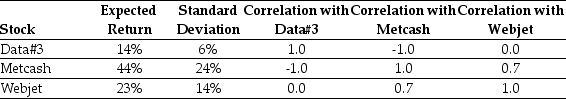

Consider the following expected returns, volatilities and correlations:

-A share market comprises 5 000 shares of company A and 2 000 shares of company B. Assume the share prices for companies A and B are $20 and $35, respectively. What is the capitalisation of the market portfolio?

Definitions:

Percentage-Of-Completion Method

An accounting method used to recognize revenue and expenses of long-term contracts proportionally to the amount of work completed.

Extractive Industry

Industries involved in the extraction of natural resources from the earth, such as mining, drilling for oil, or logging.

Allowance Method

A method of accounting for bad debts that involves estimating and recording the amount of uncollectible accounts receivable.

Direct Write-Off Method

An accounting method where uncollectible accounts receivable are directly written off against income at the time they are deemed non-recoverable.

Q1: A firm's payout policy outlines how that

Q7: What are 'bond covenants'?<br>_<br>_

Q10: The depreciation tax shield for the Shepard

Q10: What are venture capital firms?<br>_<br>_

Q17: Which of the following decision rules is

Q17: The below screen shot from Google Finance

Q53: Market frictions such as corporate taxes affect

Q75: A firm issues $200 million in straight

Q77: Which of the following equations is INCORRECT?<br>A)R<sub>p</sub>

Q87: Which of the following statements is FALSE?<br>A)If