Multiple Choice

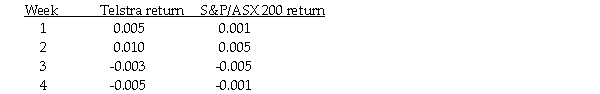

You observe that Telstra shares and the S&P/ASX 200 index have the following weekly returns:  If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

If this pattern of returns is typical of Telstra shares, and you calculated a beta against the S&P/ASX 200, which of the following is true?

Definitions:

Related Questions

Q1: Martin is offered an investment where for

Q33: According to Truong, Partington, and Peat's 2004

Q36: When we form an equally weighted portfolio

Q38: Tanner is choosing between two investment options.

Q43: Several methods should be used to provide

Q47: The Magnificent Corporation is expected to pay

Q74: A firm requires an investment of $20

Q75: Which of the following is a notable

Q90: The Capital Asset Pricing Model (CAPM)says that

Q111: The Net Present Value rule implies that