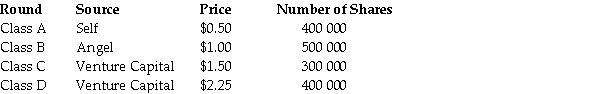

David founds a company and goes through the investment rounds shown below:  He decides to take the company public through an IPO, issuing 2 million new shares. Assuming that he successfully completes the IPO, the net income for the next year is estimated to be $8 million. His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses, which is 15.0. What will be the IPO price per share?

He decides to take the company public through an IPO, issuing 2 million new shares. Assuming that he successfully completes the IPO, the net income for the next year is estimated to be $8 million. His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses, which is 15.0. What will be the IPO price per share?

Definitions:

Masculine Characteristics

Traits traditionally associated with men, such as assertiveness, competitiveness, and physical strength, often discussed in the context of gender roles and expectations.

Good Manager

A person who effectively leads, guides, and supports their team towards achieving goals while maintaining a positive work environment.

Anglicized

The process of making something more English in style, language, or culture.

Ethnic Group

A community or population made up of people who share a common cultural background or descent, including language, tradition, and often religion or geographic origin.

Q28: When a firm reduces the number of

Q30: When a firm's investment decisions have different

Q33: You purchased HIH shares at a price

Q35: CSL, a pharmaceutical company, has a beta

Q41: A firm has a market value of

Q43: The costs of IPO are very high

Q50: What is a firm's 'cash cycle'?<br>_<br>_

Q54: The expected return of a portfolio that

Q70: What choices does a firm have in

Q93: The notional amount attaching to a dividend