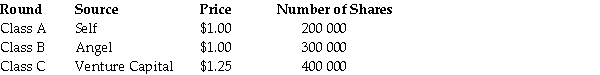

The founders and owners of a private company have funded it through the following rounds of investment:  The owners decide to take the company public through an IPO, issuing 1 million new shares. Assuming that they successfully complete the IPO, the net income for the next year is estimated to be $5 million. The price of shares is set using average price-earnings ratios for similar businesses of 17.0. What will be the IPO price per share?

The owners decide to take the company public through an IPO, issuing 1 million new shares. Assuming that they successfully complete the IPO, the net income for the next year is estimated to be $5 million. The price of shares is set using average price-earnings ratios for similar businesses of 17.0. What will be the IPO price per share?

Definitions:

Psychologists

Professionals who study cognitive, emotional, and social processes and behavior by observing, interpreting, and recording how individuals relate to one another and their environments.

Amino Acids

Organic compounds that combine to form proteins, serving as the building blocks of life.

DNA Code

The sequence of nucleotides in DNA that determines the genetic information carried by an organism.

Synthesis

The combination of ideas, information, or data to form a coherent whole or to derive new insights.

Q2: What are angel investors?<br>_<br>_

Q34: Which of the following statements is FALSE?<br>A)The

Q39: Massive Inc shares have a market capitalisation

Q60: A firm is considering investing in a

Q70: What choices does a firm have in

Q74: We can reduce volatility by investing in

Q77: Luther's 'Accounts Payable' days figure is closest

Q86: A company issues a callable (at par)five-year,

Q97: A firm has interest expense of $6

Q98: Assume that Vezuvo uses the entire $75