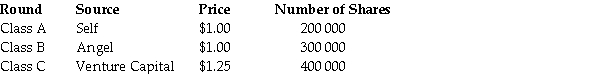

The founders and owners of a private company have funded it through the following rounds of investment:  The owners decide to take the company public through an IPO, issuing 1 million new shares. Assuming that they successfully complete the IPO, the net income for the next year is estimated to be $5 million. The price of shares is set using average price-earnings ratios for similar businesses of 17.0. What portion of the company will be owned by the angel investor after the IPO?

The owners decide to take the company public through an IPO, issuing 1 million new shares. Assuming that they successfully complete the IPO, the net income for the next year is estimated to be $5 million. The price of shares is set using average price-earnings ratios for similar businesses of 17.0. What portion of the company will be owned by the angel investor after the IPO?

Definitions:

Early Republic

The initial period of United States history following the American Revolution, characterized by the establishment and testing of the new nation's governmental systems.

Dartmouth V. Woodward

A landmark U.S. Supreme Court case in 1819 that affirmed the sanctity of contracts and contributed to the rise of corporations in America.

Corps of Discovery

The name given to the expedition led by Lewis and Clark from 1804 to 1806 by the United States to explore the newly acquired Louisiana Territory and the Pacific Northwest.

Californios

Residents of Spanish or Mexican heritage living in California before it became a part of the United States.

Q5: The financial manager should try to maximise

Q5: After the venture capitalist's investment, what percentage

Q30: A decrease in the sales of a

Q41: The 'ex-dividend date' is three business days

Q44: Which of the following statements is FALSE?<br>A)The

Q49: What are the issues in determining the

Q76: The price of BHP is $30 per

Q97: Coca-Cola Amatil (CCL)has a weighted average cost

Q100: Which of the following statements is FALSE?<br>A)A

Q102: Asymmetric information implies that creditors may have