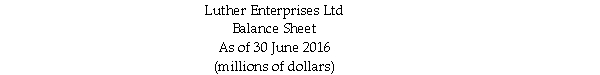

Use the table for the question(s) below.

Luther Enterprises Ltd had sales of $850 million and a cost of goods sold of $500 million in 2016.

A simplified balance sheet for the firm appears below:

-Which of the following would decrease a firm's cash conversion cycle?

Definitions:

Sales

The total receipts from transactions involving the provision of goods or services to customers.

Residual Income

This refers to the amount of net income generated by a business in excess of its minimum expected return; it is a metric used to assess the excess profit compared to the equity capital invested.

Invested Assets

Financial assets and securities that a company or individual allocates funds to with the expectation of generating income or profit.

Operating Income

Income generated from regular business operations, excluding revenue and expenses from non-operating activities.

Q4: Assuming that Ideko has a EBITDA multiple

Q10: Assume that MM's perfect capital markets conditions

Q12: Multiply the decimals using a calculator.<br>0.1 ×

Q12: Express the dosage using the official symbol/abbreviation.<br>forty-four

Q13: The firm mails dividend cheques to the

Q14: The synergies of a merger add so

Q15: Which of the following is the major

Q31: A firm that chooses a low-risk, restrictive

Q98: Assume that Vezuvo uses the entire $75

Q109: As the level of debt increases, the