Use the information for the question(s) below.

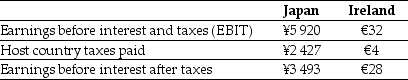

KT Enterprises, an Australian import-export trading company, is considering its international tax situation. KT's Australian tax rate is 30%. KT has significant operations in both Japan and Ireland. In Japan, the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%. In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%. KT's profits are fully and immediately repatriated, and foreign taxes paid for the current year are shown here (in millions) :

-After the Japanese taxes are paid, the amount of the earnings before interest and after taxes in dollars from the Japanese operations is closest to:

Definitions:

Selected

Chosen from a larger group through a process of elimination or qualification.

Demographic Characteristics

Statistical aspects of populations, such as age, race, gender, income level, and education, used for analysis and policy-making.

Entrepreneurs

Individuals who start, manage, and take on the risks of a business venture in the hope of turning an idea into a profitable enterprise.

Community Wealth Partners

An organization or initiative focused on creating and implementing strategies that build and sustain wealth within communities, often through social and economic development projects.

Q11: What is the dose of bleomycin that

Q13: Based upon Ideko's Sales and Operating Cost

Q18: An IV infusion of 500 mL to

Q20: Convert the metric measure.<br>1.5 mg <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3411/.jpg"

Q22: How many vials will be needed for

Q26: Which of the following statements is FALSE?<br>A)Not

Q31: Generally, Australian tax liabilities are _ until

Q51: Prada has nine million shares outstanding, generates

Q77: Suppose the domestic cost of capital for

Q96: If a firm hedges a future purchase