Use the information for the question(s) below.

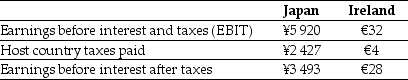

KT Enterprises, an Australian import-export trading company, is considering its international tax situation. KT's Australian tax rate is 30%. KT has significant operations in both Japan and Ireland. In Japan, the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%. In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%. KT's profits are fully and immediately repatriated, and foreign taxes paid for the current year are shown here (in millions) :

-After the Irish taxes are paid, the amount of the earnings before interest and after taxes in dollars from the Ireland operations is closest to:

Definitions:

Holder In Due Course

A holder in due course is a person who has acquired a negotiable instrument in good faith and for value, and thus has certain protections against defenses and claims that could be asserted against the original parties.

Criminal Behavior

Conduct by an individual or group that violates the criminal laws of a society, state, or other jurisdiction, deemed harmful or dangerous.

Holder In Due Course

A legal term referring to an individual who has taken possession of a negotiable instrument in good faith, with the belief that it is valid, for value, and without notice of any defects.

Judicial Sale

A sale conducted under the supervision of a court where the property is sold to satisfy a judgment or to execute a court order.

Q6: With the proper changes it is believed

Q13: Define "peripheral IV line."

Q21: The value of insurance comes from its

Q23: In practice, most acquirers pay a substantial

Q24: How many mL are needed for a

Q24: KT corporation has announced plans to acquire

Q38: A 'golden parachute' is an extremely lucrative

Q61: The spot exchange rate for the British

Q76: The payoff to the holder of a

Q85: The Modigliani-Miller dividend irrelevance proposition states that