Use the information for the question(s) below.

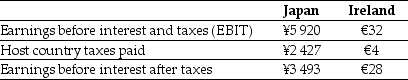

KT Enterprises, an Australian import-export trading company, is considering its international tax situation. KT's Australian tax rate is 30%. KT has significant operations in both Japan and Ireland. In Japan, the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%. In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%. KT's profits are fully and immediately repatriated, and foreign taxes paid for the current year are shown here (in millions) :

-The amount of the taxes paid in dollars for the Japanese operations is closest to:

Definitions:

Subordinates

Refers to employees or team members who are lower in hierarchical position or rank compared to their supervisors or managers.

Delegation

The assignment of authority and responsibility from one person to another to carry out specific activities while the former remains accountable for the outcome.

Competency

The ability to do something successfully or efficiently.

Policy-Making Councils

Groups or bodies that are responsible for the development and formulation of guidelines, rules, or regulations.

Q1: An antibiotic is ordered to be administered

Q2: What is the expiration date and time

Q5: What volume of diluent is recommended?

Q5: Solve the equation and express the answer

Q5: Identify the dosage measured on the syringe.

Q8: Multiply the decimals using a calculator.<br>5.34 ×

Q10: Identify the dosage measured on the syringe.

Q12: The drug label reads 4 mg/mL. Prepare

Q21: Set calibration is 20 gtt/mL. Administer 72

Q75: The foreign exchange market, also known as