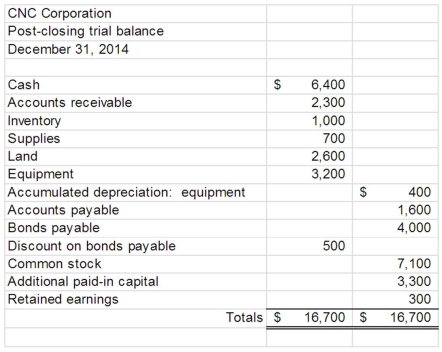

At the end of 2014, CNC Corporation's accounting information system produced the following trial balance:  CNC completed the following transactions in January 2015: a.Purchased inventory on account, $300.

CNC completed the following transactions in January 2015: a.Purchased inventory on account, $300.

B.Collected cash from customers for prior year sales, $500.

C.Paid current month's wages, $900.

D.Had land appraised.Cost of doing the appraisal (paid in cash) , $700.Appraised value of land, $3,000.

E.Sold inventory with a cost basis of $200 on account, $800.

F.Declared dividends, $50.

G.Hired additional sales staff.Expected monthly salaries, $80.

H.Purchased supplies for cash, $150.

i.Paid creditors for previous purchases, $150.

j.Signed a contract for annual employee retreat, $450.In CNC's general ledger, the account number for inventory is 105.The account number for land is 201.Which of the following transactions will involve the account numbered 301?

Definitions:

NAFTA Trade Agreement

Refers to the North American Free Trade Agreement, a treaty between Canada, Mexico, and the United States that aimed at eliminating most tariffs and barriers to trade and investment among the three countries.

Cross-Border Merger

A Cross-Border Merger involves the combination of companies from different countries to create a single global entity, aiming to expand market reach and optimize resources.

North America

A continent located in the northern hemisphere, mainly between the Atlantic and Pacific Oceans, comprising countries like the United States, Canada, and Mexico.

Internationalization Process

The strategic process that a company undergoes to expand its operations and presence into foreign markets.

Q7: Explain, in no more than ten sentences,

Q11: Consider the following REA model as you

Q12: Please refer to the following short case

Q20: Consider the following statements as you respond

Q23: You would use which QuickBooks feature to

Q24: Refer to the following case as you

Q25: To print an audit trail report:<br>A)Select Report

Q25: ABT Corporation uses block coding for its

Q41: Consider the following partially completed flowchart as

Q69: Nestor and Maureen are partners in a