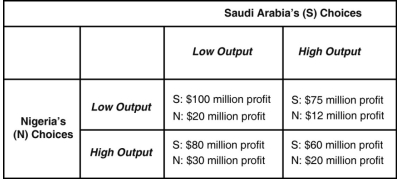

Table 11.2  Suppose OPEC has only two producers, Saudi Arabia and Nigeria.Saudi Arabia has far more oil reserves and is the lower cost producer compared to Nigeria.The payoff matrix in Table 11.2 shows the profits earned per day by each country.'Low output' corresponds to producing the OPEC assigned quota and 'high output' corresponds to producing the maximum capacity beyond the assigned quota.

Suppose OPEC has only two producers, Saudi Arabia and Nigeria.Saudi Arabia has far more oil reserves and is the lower cost producer compared to Nigeria.The payoff matrix in Table 11.2 shows the profits earned per day by each country.'Low output' corresponds to producing the OPEC assigned quota and 'high output' corresponds to producing the maximum capacity beyond the assigned quota.

-Refer to Table 11.2.Is there a dominant strategy for Nigeria and, if so, what is it?

Definitions:

Governmental Services

Services provided by the government to its citizens; these can include education, healthcare, and public safety.

Ability-to-Pay Principle

A tax principle suggesting that taxes should be levied based on the taxpayer's ability to pay, where those with higher income or wealth should pay more taxes.

Tax Burdens

The measure of the financial impact of taxes on individuals, households, or businesses, typically reflecting the total taxes paid as a percentage of income.

Taxation Theory

The study of how taxes affect the economy, focusing on the optimal design of tax policies to achieve various economic objectives.

Q65: Refer to Figure 9-12. Why won't regulators

Q104: Refer to Table 10-3. What is the

Q115: All of the following are ways by

Q121: Which of the following does not arise

Q145: A set of actions that a firm

Q151: Interdependence of firms is most common in<br>A)

Q182: Refer to Table 11-1. Let's suppose the

Q184: Which of the following statements is generally

Q212: Refer to Figure 10-4. What is the

Q270: Calling long distance is often more expensive