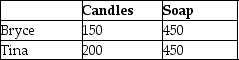

Table 13.3  Bryce and Tina are artisans who produce homemade candles and soap.Table 13.3 lists the number of candles and bars of soap Bryce and Tina can each produce in one month.

Bryce and Tina are artisans who produce homemade candles and soap.Table 13.3 lists the number of candles and bars of soap Bryce and Tina can each produce in one month.

-Refer to Table 13.3.Select the statement that accurately interprets the data in the table.

Definitions:

Average Tax Rate

The percentage of total income that is paid in taxes, indicating the proportion of an individual's income that is allocated towards taxes.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxes by the government.

Tax Schedule

A chart or formula that outlines the rate of taxation applied to various levels of income or profits.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the percentage of tax applied to your income for each tax bracket in which you qualify.

Q13: A product is considered to be rival

Q18: Roderick received a $100 savings bond for

Q20: Labour demand is considered a derived demand

Q36: In general, the supply curve for a

Q55: Horizontal equity is achieved when taxes are

Q71: Refer to Figure 15-4. What is the

Q78: If your income is $92 000 and

Q89: What is the difference between labour's marginal

Q152: An increase in a perfectly competitive firm's

Q233: Demand in factor markets differs from demand